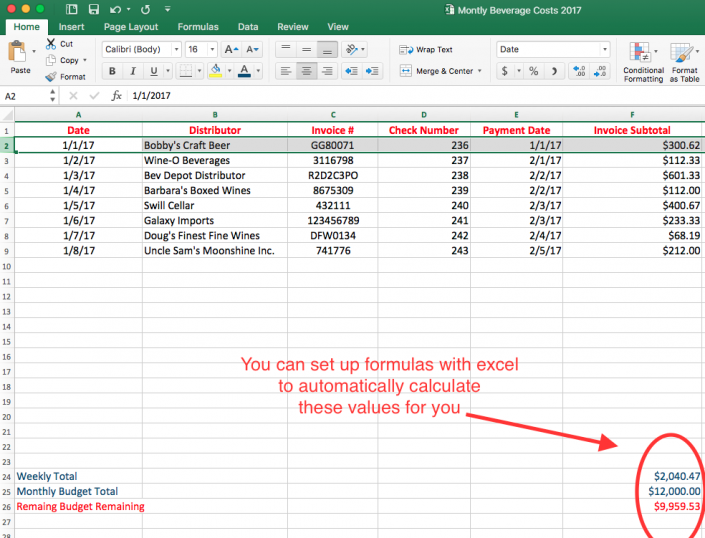

Here’s a free spreadsheet template you can use to seize control of your money! Get it here. Here’s how to start building your very own budget spreadsheet right away!įree Budget Spreadsheet – Don’t want to make your own Excel budget template? No worries, we got you covered. Whether your budget is super simple or extremely complex, this step-by-step guide will teach you how to create a budget in Excel that can quickly be customized to meet your family’s budgeting needs.

Thankfully, you don’t need to be an accountant to set up an Excel budget template. Making a budget in Excel can seem like a daunting task, especially if you don’t use the program regularly. For more about our advertising policies, read our full disclosure statement here. Should you click on these links, we may be compensated. In any organization or company, you can create the below-mentioned type of budget planner based on different criteria, where it will give a complete picture of its financial activity and health.This article may contain references to some of our advertising partners. Here, I created two conditional formatting rules to highlight cells lower than 0 and greater than 0, i.e., a complete net income row.Īt last, you can calculate yearly income, expenses & total money saved in that year with the help of the SUM function. Sometimes, if an expense is more than earnings or income, the negative value appears in the net income row therefore, we should apply conditional formatting to appear as green in color, and negative values cells appear in red. Press Enter, so the result will be as shown below. Excel automatically adds the other months. Then, select cell B1, click the cell’s lower right corner and drag it across to cell M1.

We can all add these categories in excel you can enter the different types of income and expenses category in column B. A health club (Annual or monthly memberships & spendings).Study Loan (Taken during graduation or postgraduation studies).Gifts are given on any wedding or other occasions.Investments & super contributions (Stock market or mutual funds).Paying off debt if you have taken from someone.You should know or be aware of your monthly expenses or spending, which is categorized into various sections. Family benefit payments you have received prior (monthly or annual).Income from savings and investments made (monthly or annual).Bonuses/overtime worked & payout from the company (monthly).Your partner’s or spouse take-home pay (monthly).You Should Know or Be Aware of Your Monthly Income or Earnings TEXT and String Functions in Excel (26+).Lookup and Reference Functions in Excel (36+).Excel Conditional Formatting Based on Another Cell Value.SUMPRODUCT Function with Multiple Criteria.Compare Two Columns in Excel for Matches.

0 kommentar(er)

0 kommentar(er)